Data governance has become more than just a compliance requirement; it's now a competitive advantage. With increasing regulations and the rise of data-driven decision-making, effective data governance ensures organizations can trust their data, improve operations, and drive strategic decisions.

Why It Matters Today:

With recent data breaches, AI-driven analytics, and global data privacy regulations like GDPR and CCPA, the importance of data governance has grown significantly. Business leaders view data as a strategic asset, while IT leaders focus on ensuring its security and quality.

Data Governance: A Strategic Asset for Business Leaders

Business Value of Data Governance:

Data governance reduces operational risks, enhances data quality, and improves decision-making, which directly drives efficiency and profitability.

In financial institutions, poor governance can lead to errors in transactions or regulatory reporting. Strong governance ensures accurate loan assessments and compliance, reducing risks and penalties.

Latest Trends in Data Governance for Business Leaders:

Data-as-an-Asset:

Organizations are increasingly treating data as a valuable asset, using it for monetization and strategic partnerships. Banks are monetizing customer data by offering personalized services and partnering with fintechs to improve credit scoring, leading to new revenue streams.

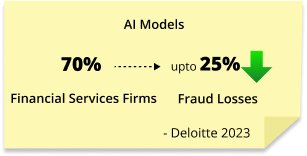

AI and Machine Learning Dependence:

AI and machine learning models require high-quality, well-governed data to function properly. Poor data governance leads to unreliable results. AI is used for fraud detection and credit scoring in banks, but without proper governance, inaccurate data can cause faulty risk assessments, potentially leading to financial losses.

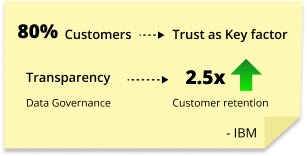

Data Ethics and Trust:

Data governance ensures responsible use of data, maintains customer trust, and ensures compliance with regulations. Strong data governance ensures that customer data in banks is used ethically and in compliance with laws like GDPR, fostering trust with customers and regulators.

Key Challenges IT Leaders Face in 2024

1. Complex Data Environments:

As organizations adopt hybrid and multi-cloud infrastructures, IT leaders face significant challenges in maintaining governance across distributed environments. This includes ensuring data security, consistency, and compliance across different platforms and cloud services.

Financial institutions often operate across multiple data environments, from on-premises databases to public clouds like AWS and Azure. IT leaders must implement robust governance solutions to ensure data is consistently managed and secure across these platforms.

2. Emerging Technologies in Governance:

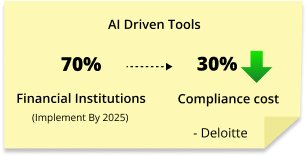

New technologies such as automated data lineage, data cataloging, and real-time data quality monitoring are helping IT leaders enhance governance. AI and machine learning can be

applied to automate compliance checks, monitor data integrity, and identify anomalies, reducing the manual burden of governance.

Banks and insurance companies are adopting AI-based governance tools to automate regulatory compliance tasks. These tools track data lineage from customer transactions to regulatory reporting, ensuring accuracy and compliance with financial laws.

3. Managing Unstructured Data:

IT leaders struggle to govern unstructured data such as emails, social media interactions, and

video content. This data type is harder to categorize and manage, yet it holds critical insights and compliance requirements, especially in industries that handle large volumes of communications and multimedia.

In financial services, customer communications (emails, chat logs, etc.) contain vital compliance-related information. IT leaders must govern this unstructured data to ensure adherence to regulations like FINRA, which mandates the retention of such records.

The Intersection of Data Governance, Privacy, and Security

Data Governance and Privacy Regulations:

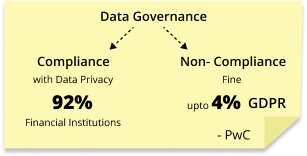

Data governance frameworks play a crucial role in aligning organizations with global privacy regulations like GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and HIPAA (Health Insurance Portability and Accountability Act).

Business leaders require flexible governance frameworks that can adapt to ever-evolving privacy laws, while IT leaders must ensure the technical implementation of these frameworks is feasible and compliant.

In the financial services sector, where personal and financial data is highly sensitive, institutions must adhere to strict regulations like GDPR and CCPA. A well-designed data governance framework ensures that banks can handle customer data responsibly, while also adjusting for changing regulatory landscapes.

Data Security is Data Governance:

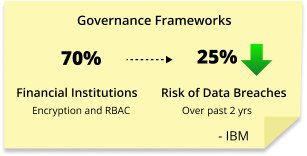

Data security and governance have become deeply intertwined. IT leaders must integrate governance with security measures like role-based access control (RBAC), encryption, and auditing to ensure sensitive data is properly protected. This holistic approach ensures that

governance policies do not just guide how data is used but also how it is secured from internal and external threats.

Financial institutions, which handle vast amounts of sensitive personal and transactional data, need to embed security directly into their data governance practices. For example, using encryption to protect customer records and implementing strict access controls ensures only authorized personnel can access or modify critical data.

Data Democratization Without Losing Control

Balancing Control and Accessibility:

As organizations adopt data democratization, they aim to provide broader access to data across teams, enabling more employees to make data-driven decisions. However, IT leaders face the challenge of ensuring data governance remains intact without creating excessive

access restrictions. Business leaders must empower employees to use data while maintaining data integrity and security.

In financial institutions, data democratization allows various departments (e.g., marketing, risk management, and customer service) to access valuable data. However, IT leaders must ensure that while this access is expanded, sensitive information (such as customer financial records) is protected through strict governance policies like role-based access controls.

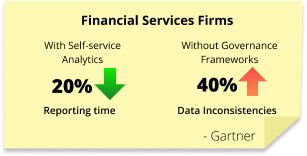

Self-Service Analytics and Governance:

Business leaders increasingly advocate for self-service analytics, where decision-makers can explore data without relying on IT departments for every query. While this boosts business agility, it requires strong governance frameworks to prevent issues like data duplication, misuse, and inconsistencies that can lead to "data chaos."

In the financial services industry, self-service analytics empowers portfolio managers, risk analysts, and other decision-makers to pull real-time data without waiting for IT intervention. However, without proper governance, this can lead to inconsistent reporting and poor financial decisions. Ensuring that all self-service analytics tools adhere to a central data governance framework is essential to maintain accuracy and compliance.

Key Takeaways for Business Leaders and IT Leaders

For Business Leaders:

- Treat data governance as a long-term strategic asset.

- Align data governance strategies with business objectives to reduce risk and enhance decision-making.

- Embrace emerging technologies, such as AI and blockchain, to future-proof governance frameworks.

For IT Leaders:

- Leverage AI and automation to scale data governance processes.

- Stay ahead of evolving regulations by building adaptive, secure governance frameworks.

- Focus on creating scalable governance architectures that support both business agility and security.

The Road Ahead:

Data governance is essential for both innovation and compliance. Business and IT leaders must collaborate to build governance systems that not only secure data but also unleash its full potential for strategic advantage.